http://www.homeappraisalsbatonrouge.com/ – Why Do Fannie Mae Appraisal Forms Include Adjustment Grid for “View”?

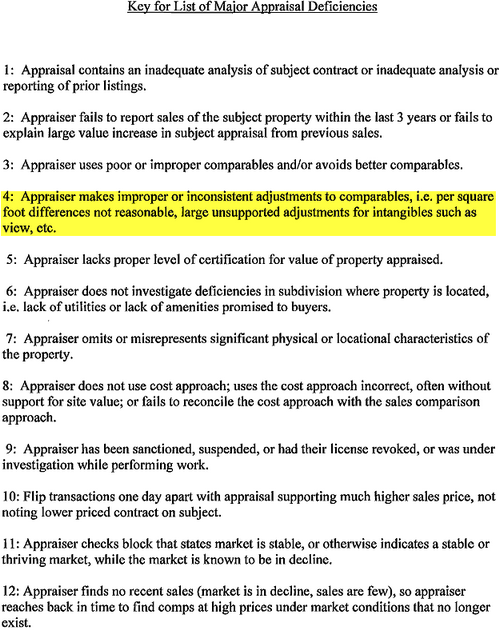

Washington State Appraiser, Dave Towne, recently offered tremendous value to home appraisers by providing a copy of a list of the Top 12 FDIC Appraisal Deficiencies, see list below. In case you are not aware, the FDIC, in order recoup loses, is filing suit against AMCs (Appraisal Management Companies) and individual appraisers for questionable appraisal work that could have led to mortgage defaults. FDIC is seeking hunreds of millions of dollars in these suits.

Washington State Appraiser, Dave Towne, recently offered tremendous value to home appraisers by providing a copy of a list of the Top 12 FDIC Appraisal Deficiencies, see list below. In case you are not aware, the FDIC, in order recoup loses, is filing suit against AMCs (Appraisal Management Companies) and individual appraisers for questionable appraisal work that could have led to mortgage defaults. FDIC is seeking hunreds of millions of dollars in these suits.

Dave said, “Appraisers….

The FDIC has recently named a major nationwide AMC in a suit involving hundreds of defaulted properties**, claiming the AMC was deficient in the way they reviewed original appraisal reports. The suit has not gone to trial yet.

Included with the suit legal documents was this list that shows issues of concern in the original appraisal reports.

This would be a good list to use to review your own reports prior to submittal.

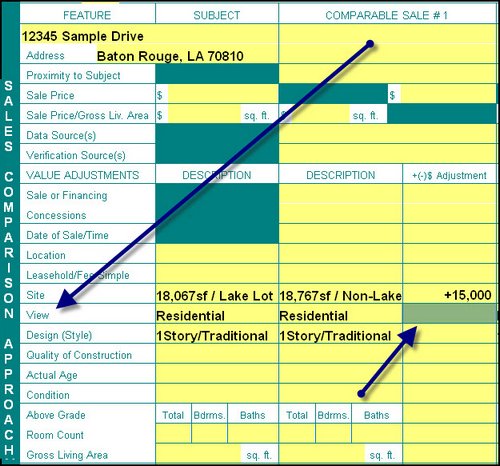

I personally found much satisfaction in #4 above about the applying “not reasonable, large unsupported adjustments for intangibles such as view, etc.” See this water front lot photo below.

My reply to Dave follows….

Thank you so very much, Dave!!!

I LOVE YOUR #4, about applying non-supportable adjustments for “view”. There is no such adjustment and I don’t understand why FNMA even has that in the grid. Dave, when a buyer closes on a lake lot, do they have “2” closings, one for the site value and another separate closing for the lake view? No they don’t….and that would be insane wouldn’t it? There is no such thing as a supportable “View” adjustment. The entire value in a lot is the “Site” itself and all of the attributes of that site: land, size, view, historic trees, etc.. It all makes up the “Site Value”. And, based on what you’ve sent us, I’m not the only appraiser or regulatory agency who polices appraisers who thinks this way!